Strong internet presence drives constant stream of jobs to bid on. The business shares office space with another of the owners’ businesses so it will need to be relocated. The company recently went to a 3rd party installation force thus reducing overhead which does not yet reflect in the net income numbers.

Sales and Installation includes, Smart Home, Security Systems, Home Theatre, Lighting Control, Phone Systems, Commercial low voltage wiring, etc.

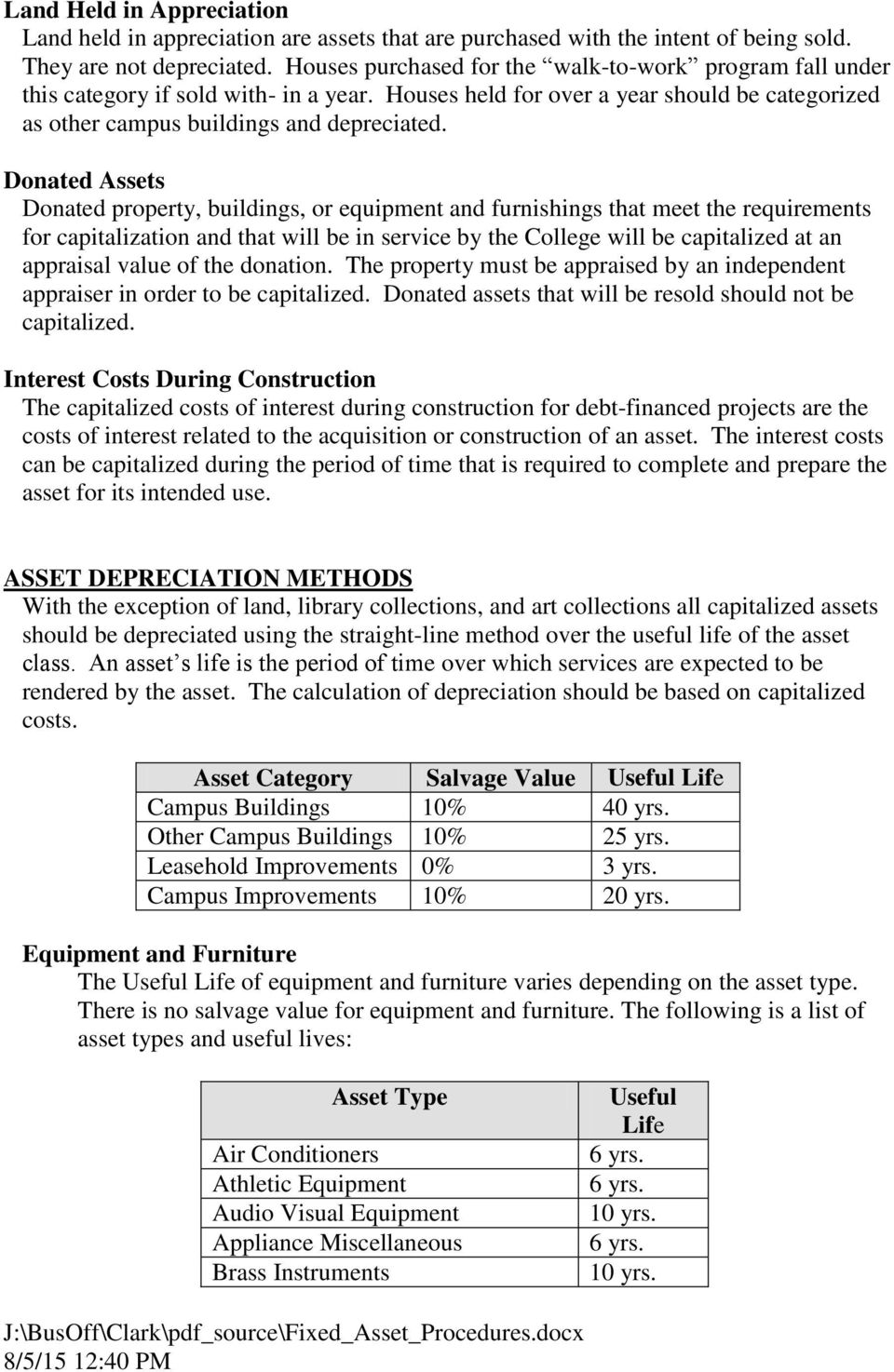

DEPRECIATION FOR AUDIO VISUAL LIGHTING DOWNLOAD

This highly respected Audio / Visual company specializes in all new technology available for residential and commercial customers. Graph and download economic data for Depreciation and Amortization Charges for Motion Picture and Video Production and Distribution,All Establishments, Employer Firms (DISCONTINUED) (EXPDACEF5121XALLEST) from 2005 to 2007 about amortization, video, depreciation, audio-visual, distributive, employer firms, accounting, establishments, expenditures, production, services, and USA. If no real estate value is listed, it was not provided by the seller. May be included in the asking price or offered separately. The value of property owned by the business. If there is no inventory price listed then the seller did not provide it.įurniture, fixtures and equipment that will remain with the business, such as desks, office cubicles, decor elements of a restaurant or showroom, computers and office machines, pots and pans, dishes, display cases, manufacturing equipment, etc., depending on the type of business. The value of the merchandise, raw materials, and finished and unfinished products which have not yet been sold. Then, add back in any payments made to the owner, interest and any depreciation of assets." For example, if the net profit before taxes was $100,000 and the owner was paid $70,000 then the cash flow is $170,000.Įarnings Before Interest, Taxes, Depreciation and Amortization. The total asking price of the business for sale.Īll income the business received before any cost-of-sales or expenses have been deducted.Īrrived at by "starting with your net (before tax) profit.

0 kommentar(er)

0 kommentar(er)